From Garage to Global: The Incredible Growth Story of Gymshark

Exploring the Business Model and Marketing Strategies that Fueled Gymshark's Growth

Gymshark is a fitness apparel brand that has taken the world by storm. The Birmingham-based company was founded in 2012 by Ben Francis, a teenager working out of his parents' garage. Since then, Gymshark has experienced explosive growth, becoming one of the most popular fitness brands in the world. In just over a decade, Gymshark’s innovative business model and effective marketing strategies have driven the company to a valuation of over £1 billion, and a net worth of over £700 million for its otherwise modest founder.

Gymshark’s story is the kind that we all love to see. A modern, Great British, boy-done-good success story. Today we are going to dive in, and uncover some of the drivers of this immensely successful business.

We’re going to look at two key aspects which Gymshark was particularly innovative with, and, in my opinion, were the real drivers & enablers of this rapid growth.

First of all, we are going to examine Gymsharks marketing strategies. How did Gymshark drive such high demand for its products? How did they gain credibility as a relatively unknown brand? We will also take a look at how this has evolved and matured as the business has grown to its current, global, scale.

Then we will take a look at the business model, and the financial/operational decisions that enabled Gymshark to grow so quickly, without being well capitalised or funded.

Overall you are going to see a great example of a modern, disruptive, D2C business. But unlike a lot of the other so-called ‘disruptive’ businesses we see these days, you will observe that Gymshark kept the fundamentals of doing good business close to heart the entire time. Something a lot of the exciting VC-backed startups we see these days could learn from.

Let’s start with marketing. More specifically let’s start by examining the brand and how it became credible.

Creating A Credible Brand

Ben Francis' own interests in fitness played a significant role in establishing early credibility for Gymshark. As a fitness enthusiast himself, Francis had a deep understanding of the needs and preferences of the brand's target audience. He knew what fitness enthusiasts were looking for in their clothing, and he was able to design products that catered to those needs. He was also able to be his own brand ambassador, and was often seen working out in Gymshark's clothing, which demonstrated his belief in the quality and functionality of the products he was selling.

Francis was also proactive in engaging with the fitness community directly during Gymshark's early years. He regularly attended fitness events and trade shows, where he would interact with customers and gather feedback on Gymshark's products. This hands-on approach helped the brand build a strong relationship with its early customers, which further bolstered its credibility in the fitness industry. Outside of the gym, he was also an ambassador for the company itself. As the business grew, he successfully built a strong personal brand as an emerging businessperson.

The early credibility that was created for Gymshark within the fitness community, combined with its good quality and stylish products, meant that many people in the fitness community were more than happy to wear Gymshark clothing. Over and above that though, they were happy to post up content on social media wearing it too. This created the early foundations of the Gymshark ‘community’, an idea they have leaned into as a brand even more since.

After gaining good initial traction, Gymshark was very quick to capitalise on scaling up these marketing channels. Having seen the effects of social media influence early on, they swiftly began a campaign of gifting and sponsoring fitness influencers to wear their products, post content, and drive sales. The decision to invest deeply in this marketing strategy is clearly much easier to make when you have already assessed its effectiveness.

This investment in marketing efforts reinforced the brand message and credibility of Gymshark, and created a virality/flywheel effect from their happy customers, who generally went on to make multiple/repeat purchases, and recommend the brand to others. This loyalty and evangelism meant that these marketing strategies were not only good at creating hyper-growth for the brand … they were also profitable. Two things which, these days, often don’t go hand in hand.

Now that Gymshark has established a strong customer base here in the UK, the marketing strategy has been to double down on Community, Content, and CRM, with the aim of maintaining strong relationships and fostering loyalty with their customer base. They are also attempting to reach new markets, especially in the US where they have established a physical presence with new premises and warehouses in Denver.

Meanwhile, they are also attempting to build their credibility to new levels here in their home market, by going full circle with the launch of their first retail store. A flagship store on Regent Street, in central London, which was opened in Late 2022.

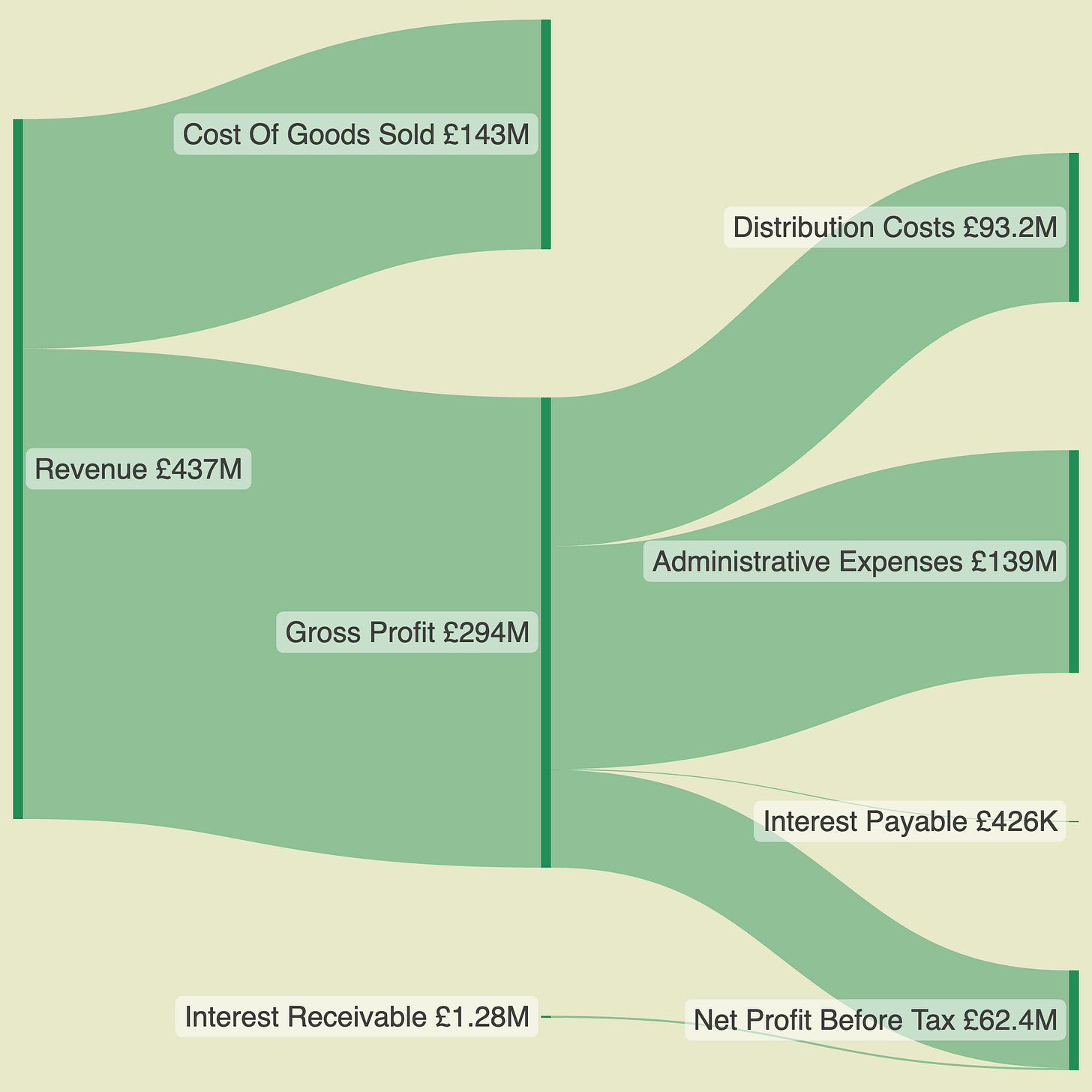

Now let’s take our first peak at the numbers that these marketing strategies were able to generate.

These numbers are clearly very impressive. Most tech companies would be envious of this level of sales and growth over a relatively short space of time. However, I think comparing these numbers to tech companies does Ben Francis, and Gymshark, an injustice.

It’s one thing to grow this fast with a digital product launched with VC-rocket-fuel such as Spotify, Facebook, or Google … but it’s another challenge entirely to scale a business like this, when you are dealing with physical products, and all the logistics and operations that are involved. This challenge is only amplified when considering the fact that Gymshark was entirely self funded up until August 2020.

Only once you realise the implications of these two factors, can you truly appreciate how much of an achievement it really is, to scale a business in this sector, to this degree. So how did they do it, and what was the secret sauce? To understand this we need to dive further into their operations and their financial mechanics.

Creating A Best-In-Class Operation

Many successful well-funded businesses in this world get by without actually running a world class operation. For a self funded business like Gymshark though, this is not an option. For Gymshark to grow the way it has, in a physical goods business, it needed to achieve an astounding level of capital efficiency. A necessary condition for that is to run an extremely tight ship and a slick operation - best in class even, to stand a chance of meeting the excessive levels of demand their marketing strategies were creating. Well, Gymshark did it.

Fundamentally, in a traditional physical products business, the level of sales achievable is limited by the amount of stock you can hold/produce. This, in turn, bears a close relationship to the financing and capital that a business has access to - a major limiting factor in the business model.

Some of the major levers which Gymshark used to overcome these challenges were:

Dropshipping

in the early years Gymshark used dropshipping as a way of fulfilling demand, without needing the capital up front to pay for stock.

Customer places order → Gymshark orders from Supplier → Supplier produces and ships the order directly to the customer

This method has its limitations, as orders can take time to produce and ship. In Gymshark’s case this added to the hype and perceived popularity of their products.

The benefits of the model are that you do not need to hold stock on your own balance sheet, reducing the capital requirements of running your business. Moreover, suppliers will often grant 90 day payment terms to their most reliable customers. This time difference between receiving immediate payment from the customer and paying the supplier gives businesses a natural source of finance.

Once a supply chain is well established, certain suppliers may also take a view that they will maintain a stock of your product, to help them with planning, keeping up with demand, or to benefit from economies of scale - giving some of the benefits of holding stock, without it being on your own balance sheet.

Stock Control

At a certain point in Gymsharks development, controlling its own supply chain by holding stock became more important. This is very capital intensive.

Gymshark has employed a high level of discipline in the early years when it came to how much stock to hold at a given time. Rather than holding lots of stock of every item, they emphasised the importance of staying in stock of their best selling items, without holding excess levels of inventory for slower-moving items.

Fundamentally, this is a simple case of making the most of what you have.

What actually enabled Gymshark to do that task well? It’s all about understanding their customers and their buying habits. At first, with a smaller range, this is a relatively easy/intuitive task for someone who has their finger on the pulse of their business.

However, as Gymshark sales increase, and their range of products and operational complexity grows, this task becomes exponentially more challenging and complex. This is where Gymshark’s innovative approach to technology has enabled them to maintain the same quality of decision making.

By using integrated technology, Gymshark is able to harvest behavioural data on their customers, which is used at scale by predictive data analytics tools to aid best practices when it comes to how much stock to hold, and where to hold it.

Just-In-Time Logistics

The supply chain and shipping lead times for new stock also plays a big role in the capital requirements of a business like Gymshark. The reliability, speed, and cost of shipping goods all play a role here.

If you have a reliable supply chain, it allows you to hold a smaller buffer of stock, and to feel confident in receiving stock just-in-time. Reducing the capital requirements on the business further.

In addition to this, there is also a question of speed vs cost which businesses like Gymshark need to answer when it comes to logistics. Air freight for example can take a few days to reach its destination, versus ocean freight which typically takes around one month depending on the destination (but is cheaper). The key questions to answer here are something like the following:

If using Air Freight allows me to have less capital tied up, can I put that capital to good use and drive more sales and cash into the business?

Is this additional level of sales and cash flow adequately covering the added cost of using quicker, more expensive, freight methods?

Lean Cost Base / Reinvestment

Aside from these factors, Gymshark has also maintained a high level of discipline when it comes to its cost base. It opts to do things in a capital efficient way, and refrain from unnecessary overhead expenses that reduce the level of cash available to reinvest in the business.

It’s taken a similarly disciplined approach when it comes to taking capital out of the business. Instead of opting to withdraw large portions of profits, Gymshark has historically preferred to reinvest in the future operations and capabilities of the business. This is a hallmark of many successful long-term-thinking companies.

Needless to say, Gymshark has dramatically snowballed and grown the capital available to the business through the reinvestment of these retained profits.

Finance

Lastly, when you have a successful, well ran, business - trade finance becomes an option. These are operating lines of credit which are made available to businesses by banks. The safest and most robust businesses receive highly competitive rates to use funding to operate and grow their business where capital is not available, without giving up equity in the business. Naturally, this is a much more private topic, and therefore it’s unclear exactly how Gymshark may have used this lever to grow its business.

We do know however, that Gymshark has also raised money from a minority equity investment in the company, in 2020, when Private Equity firm General Atlantic invested £200M into Gymshark, valuing the company at over £1B. The thesis of this investment being an entry into the gigantic US market, where Gymshark looks to replicate the success it has had here in the UK. Judging by their FY2021 results, summarised below, this investment seems to be on the right track, and i’m certainly looking forward to delving into their FY2022 results when they become available.

Summarising

In conclusion, Gymshark is a remarkable success story that has captured the hearts and wallets of fitness enthusiasts around the world. The company's innovative marketing strategies, combined with a sound business model, have enabled it to achieve explosive growth in just over a decade. By creating a credible brand within the fitness community, leveraging social media influencers, and fostering customer loyalty, Gymshark has built a devoted following that has propelled it to a valuation of over £1 billion.

Despite its rapid growth, Gymshark has remained true to the fundamentals of good business. It has focused on creating high-quality products that cater to the needs of its customers, while simultaneously building strong operational and capital efficiency into their business model and practices. These principles have allowed the company to grow quickly without being well capitalised or funded, and to maintain profitability throughout its journey.

As Gymshark continues to expand and build its presence in new markets, it will be interesting to see how it navigates the challenges that come with hyper-growth. However, with a talented team, a loyal customer base, and a commitment to innovation, Gymshark is well-positioned to continue its upward trajectory for years to come.