Maximising Returns and Minimising Taxes: The UK’s Most Tax-Efficient Investment Vehicles

From Tax-Free Gains and Government Bonuses, to Tax Rebates and Loss Relief - These Investment Vehicles Can Increase Returns and Save You Thousands

Whether you’re an early stage professional earning £50k a year, or a multimillionaire … I am sure you would like to pay less tax. Even better if this can be done in a moral and legitimate way, without taking money abroad or exploiting complex loopholes in the law with convoluted shell companies and offshore accounts like we see many of our politicians do.

This article takes a look at the best and most tax efficient investment vehicles available in the UK. The good news is - they’re hiding in plain site, and can save you thousands of pounds in tax each year if used wisely.

Benjamin Franklin once said: “in this world, nothing is certain except death and taxes” … I say let’s try to reduce our taxes so that at least we can die rich!

There are three main tax bills in the UK which people can try to minimise. We are going to cover all of them here. These are income tax, capital gains tax, and inheritance tax. Income tax is a tax on an individual's wages or salary, while capital gains tax is a tax on the profit made from selling an asset that has increased in value. Finally, inheritance tax is a tax on the transfer of assets upon death.

Before we get into the investment vehicles that can help reduce some of these burdens, it’s important to remind you that this article is for information purposes only, and does not constitute financial advice. You should exercise your own best judgment, or consult with a financial advisor, accountant, or tax professional before deciding that a particular type of investment is for you.

I am going to run through the investment vehicles roughly in order of their liquidity. Starting with the simplest and most accessible investment vehicles, before moving onto more complex and longer term options that will lock away funds. Lastly, we will cover pensions and investments that are efficient when it comes to inheritance tax.

Individual Savings Accounts (ISAs)

Starting with the basics, let’s talk ISAs. ISAs are tax-free savings and investment accounts that allow individuals to save and invest up to a certain amount each year without paying tax on the interest or capital gains earned. There are several types of ISAs, including Cash ISAs, Stocks and Shares ISAs, and Innovative Finance ISAs.

At the time of writing, each tax year you can save up to £20,000 in one type of account, or split the allowance across some or all of the other types.

Cash ISAs are available from most high street banks, offer a simple way to save up cash, and benefit from a tax-free rate of interest. Remember that moving money in and out of this type of account will eat away at your allowance, so if you are planning to max out your ISA allowance each year, don’t carelessly deplete your allowance by moving funds back and forth between accounts. At the time of writing, the top rate of interest available in the market for this type of account was 4% AER.

Next up are Stocks and Shares ISAs, and if you have a higher appetite for risk with your savings, or 4% interest just doesn’t float your boat, this type of account may give you the options you are looking for. With this type of account, you still benefit from tax-free returns on your investments, but you get to choose the investments yourself - for example by buying shares in listed companies. If you don’t know what to invest in, you can always invest into a tracker fund, which will track the performance of the overall market.

This is my own personal favourite type of account, which I use to invest excess funds into liquid investments like stocks and shares. Two reputable platforms you can open this type of account with are AJ Bell and Hargreaves Lansdown. The key benefit here is that, if your returns are good, you can snowball your investments into a much bigger sum, continue to benefit from tax-free returns, and still be able to liquidate your investments into cash (during market operating hours) if you need it. The downside is that investments can go down as well as up, and so you should be prepared for that eventuality, and ensure you have access to enough cash to meet your needs at all times.

Innovative Finance ISAs are even more niche. These accounts allow individuals to invest in certain types of peer-to-peer (P2P) loans and, again, receive tax-free returns. These P2P loans can include personal loans, business loans, and property loans. P2P loans can offer higher returns than traditional savings accounts or bonds, but also come with more risk - as there is no guarantee that the borrower will repay the loan. Depending on the platform used and the details of the specific P2P loan chosen, there can also be a lack of liquidity - you may have to wait for the loan to be repaid to access your money. I have far less experience and knowledge on this type of product, but wanted to include it for completeness.

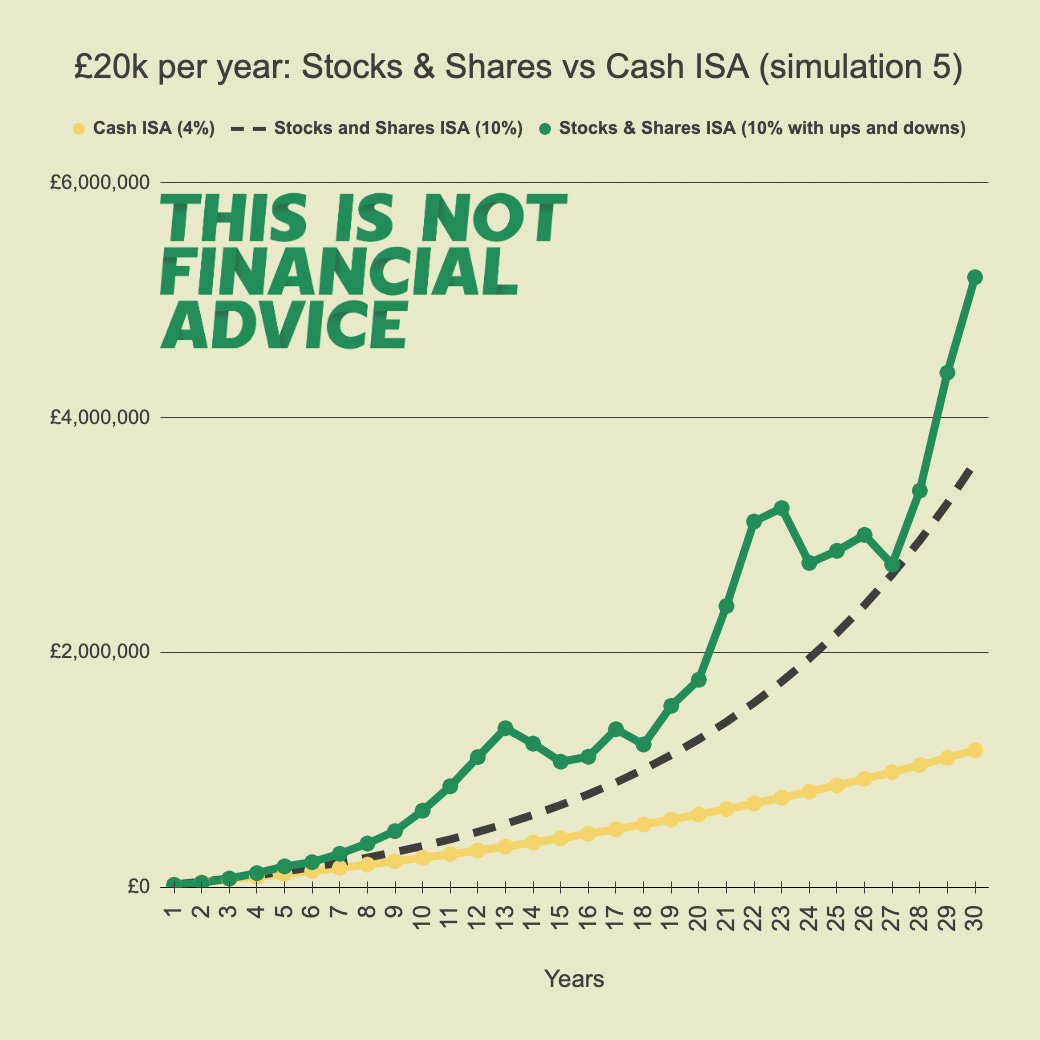

To give you an idea of the kind of returns that cash ISAs and stocks & shares ISAs could generate over a long period of time, I ran 5 simulations. In these, I show the value of a portfolio when investing solely in a 4% cash ISA, versus investing in a stocks & shares ISA with average returns of 10% per year. Since the stock market is unpredictable, I wanted to give you an idea of the kind of value fluctuations that are possible when investing in the stock market, by introducing noise in the data with a standard deviation of 15% (meaning that on average, each year, the returns are +/- 15% versus an average of 10%). Note - these simulations were done completely at random using the parameters described.

As you can see, the potential outcomes are wide ranging, with simulation 5 becoming a millionaire in 12 years, and simulation 4 not even making it after 30 years. Overall though, statistically and historically, investing in the stock market has given a better chance of superior returns versus interest on cash. In all cases though, we generated large returns, that are completely free of tax, with both types of account.

BONUS: The Lifetime ISA (for if you are saving to buy a property) this is another interesting product, especially if you are looking to buy your first property. It allows individuals who are aged between 18 and 39 to save up to £4,000 per year, and receive a 25% bonus from the government on their savings, up to a maximum of £1,000 per year. There are several high street banks which offer a cash Lifetime ISA, as well as AJ Bell and Hargreaves Lansdown who offer a Stocks and Shares equivalent.

The funds saved in a Lifetime ISA can be used for either a first-time home purchase or for retirement, and also benefit from tax-free returns. You can access your funds for other reasons too, but in this case you pay a 25% withdrawal fee (which amounts to paying back the government bonus, and a little extra). Therefore you should think carefully, and be sure you are going to want to purchase a property in the future. You should also be sure that the price of your first property will be below the limit - at the time of writing this was just £450k, which may not get you what you need in London for example.

After just a few years, you can already start to see the difference that the governments bonus has on the size of deposit saved, and therefore the kind of properties that the saver can afford. This account can be combined with a normal ISA too, if you have more than £4k to save each year. Just remember that the total annual ISA limit is £20k between all of your accounts, including the lifetime ISA.

Venture Capital Schemes (EIS, SEIS, VCTs)

Now let’s get into some non-liquid investment vehicles. By their very nature, these investments are more complex, illiquid, and higher risk. If you think these ideas are something you are interested in, it’s highly advisable to speak to a professional before making a decision to invest. If you invest using one of these schemes, you will also likely need to begin filing tax returns, if you don’t do that already.

The main types of investments I want to talk about here are EIS, SEIS, and VCTs. All three schemes are based on investing in privately owned, unlisted businesses.

The Enterprise Investment Scheme allows individuals to invest in certain types of privately owned business, and write off or reclaim 30% from your income tax bill, defer capital gains tax you may have due, and earn returns free from capital gains tax, upto a very generous threshold of £1M per year. Its sister scheme is the Seed Enterprise Investment Scheme is very similar, but is targeted at earlier stage companies who are raising their first funds, the tax benefits are more generous, but the investments themselves are usually higher risk, and the threshold for investment is £100k per year at the time of writing. Finally, Venture Capital Trusts are listed companies that invest in early stage companies which meet requirements that allow investors to claim similar tax reliefs to those using the EIS and SEIS schemes.

These types of investments are high risk, but the schemes themselves offer potentially huge amounts of tax relief and risk limitation. This makes these types of investment particularly attractive to those with excess cash, and big tax bills - especially if they are knowledgeable on the businesses that they choose to invest in, and comfortable with risk. It’s important to note that these really are very illiquid investments. Once made, you will not be able to access your funds and will not be able to for the foreseeable future, unless the company makes an exit. Generally the investment horizon is around 5 to 10 years.

There are several key tax benefits to investing in these schemes:

Income Tax Relief - first and foremost, all three schemes offer up to 30% income tax relief on investments made (50% for SEIS). This means that on a £10k investment, you could claim a tax deduction/rebate of £3k (or £5k for SEIS). This immediately brings down the effective cost of these investments significantly.

Capital Gains Deferral Relief - what’s more, if you are due to pay any capital gains tax, or have paid capital gains tax on something in the last few years, you may also be able to defer or reclaim this amount, and pay it later (when you exit your investment). Deferral Relief lets you treat the gain as not arising until some future date, as long as you use the funds to acquire EIS or SEIS eligible shares.

Capital Gains Disposal Relief - now let’s talk about exits. There’s large tax benefits here too. Ordinarily, exiting an investment for profit would count as a taxable capital gain. With these scheme’s though, this is not the case - provided you have held the shares for more than 3 years, no capital gains tax will be due on exit.

Loss Relief - and what about if things don’t go so well? If you sell your EIS shares at a loss, you can choose to offset the loss amount, less any Income Tax relief already given, against your income. You can do this for the tax year that you sold the shares or the tax year before. For someone paying the top, 45p, rate of tax, this would effectively mean losing no more than 38.5p in the pound for an investment that went wrong.

Each of these investment vehicles is slightly different. But all three share common limitations based on the high-risk nature of investments, the illiquidity during the investment period, as well as the 3+ year time horizon, and the admin involved in taking advantage of these schemes.

To try and clarify some of the differences with these schemes, I have put together a comparison with some examples below. However, as stressed already, these schemes are complex, and therefore you should always seek expert advice before jumping in to any of these schemes, and consider your own unique circumstances.

EIS Scheme

Annual Limit - £1M invested (and up to an additional £1M per year for knowledge intensive companies)

Income Tax Relief - up to 30% of the amount invested

CGT Deferral - invest a capital gain in an EIS eligible investment, and reclaim/defer 100% of the capital gains tax due until you exit

CGT Disposal - no capital gains tax payable if held for 3+ years

Loss Relief - when exiting for a loss, you can offset the loss (less any relief already received) against income and/or capital gains

Conditions - less than 250 FT employees, gross assets less than £15M, limit of £5M EIS investment per year up to a maximum of £12M in the lifetime of the company, company must be trading for less than 7 years

Time Horizons - 3+ years

Dividends - no tax relief

IHT Relief - inheritance tax exempt after 2 years

Example: you pay income tax in excess of £5k each year, have a capital gains tax bill due in excess of £2k, and decide to invest £10k into an EIS eligible company.

You get to claim back 30% of your investment from your income tax bill (£3k)

You decide to defer paying £2k of CGT on £10k of your capital gains

Your effective up front cost for this £10k investment comes down to £5k

You hold on to your investment for over 3 years, and the company is acquired for triple the valuation that you invested at

You receive £30k from your original investment tax-free, and repay the CGT of £2k that you deferred, at the time of exit, netting you £28k

Net effect of the scheme in this example was that it amplified your returns from 2.6x without all the tax relief to effectively 5.6x with it

SEIS Scheme

Annual Limit - £100k invested

Income Tax Relief - up to 50% of the amount invested

CGT Deferral - invest a capital gain in an EIS eligible investment, and reclaim/defer 50% of the capital gains tax due until you exit

CGT Disposal - no capital gains tax payable if held for 3+ years

Loss Relief - when exiting for a loss, you can offset the loss (less any relief already received) against income and/or capital gains

Conditions - fewer than 25 FT employees, gross assets less than £200k, not yet raised money through EIS or VCT schemes

Time Horizons - 3+ years

Dividends - no tax relief

IHT Relief - inheritance tax exempt after 2 years

Example: you pay the 45p rate of income tax each year, have no capital gains to claim or defer, and decide to invest £20k into an SEIS eligible company

You get to claim back 50% of your investment from your income tax bill (£10k)

Your effective up front cost for this £20k investment works out to £10k

You hold on to your investment for 5 years, but in the end the company is unsuccessful and is sold for just 10% of the valuation you invested at

You receive £2000 from the sale, meaning a gross loss of £8k

You write off the £8k loss against your income, reducing your tax bill by 45% of £8k, saving you £3.6k

In this example, even though the company failed, the effective loss from the investment after tax relief worked out to be just £4.4k, versus an effective £14.4k loss had you invested £20k in the company without using the scheme

VCT Scheme

Annual Limit - £200k invested

Income Tax Relief - up to 30% of the amount invested

CGT Deferral - no deferral allowed

CGT Disposal - no capital gains tax due

Loss Relief - no loss relief

Conditions - less than 250 FT employees, raising less than £5M per year

Time Horizons - 5+ years

Dividends - no dividend tax payable

IHT Relief - no inheritance tax relief

Example: you pay £30k in income tax each year, want to invest £100k into a VCT, you have capital gains but you can’t defer them using the VCT.

Upon investing £100k in the VCT, you claim back £30k from your income tax bill

The VCT goes on to invest only in eligible companies, and does so successfully

After 6 years, the VCT liquidates its investments, netting a 3x return

The VCT returns your funds of £300k, which is fully exempt from capital gains tax

Net effect being a ~4.3x return, versus a 2.6x return without income/CGT relief

There is also the Social Investment Tax Relief scheme, another venture capital scheme, with similar tax benefits to the EIS scheme, but with a focus on social enterprises that are working towards a community interest rather than solely profits.

Other Tax Efficient Investments

There are several other more niche investments which can be tax efficient. For example, certain types of alternative assets, that can go up in value over time, are exempt from capital gains tax.

Some examples include watches, vintage cars, and an old favourite from country estates - collectible guns. Some of these assets can go up in value over time, yet aren’t liable for capital gains tax when sold. When executed well, the rich can enjoy ownership of these items over a long period of time, whilst also seeing their value go up over time, without needing to pay capital gains tax when selling.

There are also more conventional/accessible investments like NS & I premium bonds, which are also tax free.

Pensions & SIPPs

Now we have covered illiquid investments, let’s talk about a category of investments that you can’t access until aged 55+ … pensions. Saving in a pension plan can provide tax benefits in a few different ways.

Contributions to a pension plan can be made from pre-tax income, which reduces your overall taxable income and can lower the amount of income tax you owe.

The money in your pension plan grows tax-free until you withdraw it in retirement. This means that you don't have to pay taxes on any investment gains or interest earned in the plan.

Withdrawals from pension plans are taxed as income, but you may be able to take advantage of a lower tax rate, depending on your other income in retirement.

Not only that but it’s common for employers to make or match contributions to pensions too, meaning your investment in your pension could be boosted even further by your employer too.

Outside of workplace pensions, Personal Pensions, and Self Invested Personal Pensions (SIPPs) are a type of UK pension plan that allows individuals to take more control over their retirement savings. SIPPs work like a personal pension scheme, but with more investment choices and more control over your savings. You can choose from a wide range of investments, such as shares, bonds, and property, and you can switch between them at any time.

One of the main advantages of a SIPP is that it allows you to take more control over your retirement savings and make investment decisions that align with your personal financial goals and risk tolerance. However, it also requires more knowledge and research, as you are responsible for choosing and managing your own investments.

My own personal approach is to transfer my workplace pensions from previous employers into one SIPP with AJ Bell, while keeping my workplace pension active with my current employer. Each time I change jobs, I transfer funds over from my old pension, to my SIPP, so I can maintain control and visibility of the funds and investments. Please note that this approach may not be suitable for you, and if you are in any doubt you should seek professional advice.

It’s important to understand your pension in detail, as with such a long term investment, small details and optimisations can accumulate and compound into very significant changes in the total value of your pension pot by the time you retire.

Inheritance Tax Investments

At the start of this article, we joked about the certainty of death and taxes. Another ironic certainty in life is that when you die, there will still be taxes. These next few investment schemes are designed to reduce that burden on your next of kin, and maximise the level of wealth you are able to pass on.

Business Relief: Business Relief (BR) is a provision that allows certain business assets to be passed on to beneficiaries at a reduced rate of IHT, or potentially even free of IHT. To qualify for BR, the business assets must meet certain conditions, such as being shares in an unlisted trading company or certain types of land and buildings used for the trade. Business Relief can also apply to certain types of assets such as intellectual property, renewable energy related assets and certain types of investments. It's important to note that the business must have been owned and controlled by the deceased for a minimum of 2 years to qualify for BR.

Agricultural Property Relief: Agricultural Property Relief (APR) allows agricultural land and buildings to be passed on to beneficiaries at a reduced rate of IHT, or potentially even free of IHT. To qualify for APR, the land must have been used for agricultural purposes for at least two years before the date of death. This means that the land must have been used for the purposes of farming, forestry or the breeding and keeping of horses, cattle or sheep.

Alternative Assets: Certain alternative assets, such as art, antiques, and vintage cars, can be passed on to beneficiaries at a reduced rate of IHT if they meet certain conditions. For example, a valuable artwork must be considered as "wasting assets" (assets that have an expected life of less than 50 years) and must have been owned by the deceased for at least 2 years. Most of the alternative assets mentioned earlier in this article would fall into this category.

Trusts: Setting up a trust can help to reduce IHT liability by transferring assets out of the estate and into the trust, which can then be passed on to beneficiaries. There are different types of trusts, such as bare trusts, interest in possession trusts, discretionary trusts, and more. Each of them has different rules and regulations and it's important to seek professional advice on which one is suitable for your circumstances. Trusts can also be used in conjunction with other IHT planning strategies, such as giving away assets or making gifts.

It's important to note that the specific requirements and conditions for each of these investment vehicles can vary, and professional advice should be sought before implementing any IHT planning strategy as these are a complex area of UK tax law and regulations are subject to change!

Conclusion

To sum up, I would reiterate that this article does not constitute financial advice, and you should use your best judgement before implementing any of the investment strategies outlined here, or speak with a financial adviser if you are unsure.

We talked about ISAs, which give tax free savings and capital gains - including Stocks & Shares and Lifetime ISAs.

Venture Capital Schemes that offer income tax, capital gains, and loss relief.

Alternative Investments that are CGT free like premium bonds and alternative assets.

We covered the benefits of Pensions and SIPPs.

Lastly, we covered some investment vehicles that can provide inheritance tax relief.

This article is for inspiration, ideas, and knowledge of the schemes - and with the right advice, I hope you find ways to successfully implement them into your own financial planning!