The Ins and Outs of Flipping High-End Timepieces

A Low-Risk, Minimal-Effort Strategy I Used to Make Over £5k Extra Last Year

A few weeks ago I wrote an article on how luxury watches can make for sound investments. This week I am going to look at this topic from another angle.

Rather than considering watches as a long-term investment, what if we looked at how we can flip them for profit instead? After my first article on watches last month, I had several conversations with readers about which watches I liked, and which I have invested in or flipped in the past.

Flipping watches doesn’t really count as ‘investing’, as there is work involved. However, it’s a universal truth that people are always intrigued by the notion of making a quick buck, so here’s a guide on how to do just that, from someone that has done it before.

Here’s how I have made over £5000 extra last year, with minimal effort and risk, from occasionally flipping watches.

I’m going to cover one specific angle here with the aim of making a few thousand pounds periodically, with minimal effort/risk.

What I am not going to cover (although it is possible), is treating watch flipping as a ‘proper’ side hustle - investing more time for a steadier stream of income. This comes with more risk and time investment, and is beyond the scope of my skill-set and this article. Let’s get into it!

The Method: Get hold of a brand new watch, which is selling above retail price on the second-hand market.

Why would a second hand watch be selling for more than the retail price? We covered this in a previous article, but it all comes down to Supply & Demand. Watch manufacturers like Rolex, Patek Philippe, and others will often deliberately undersupply the market with watches. This lack of supply, coupled with strong demand, leads to watches being unavailable, and thus the prices on the second-hand market surge.

The idea here is to go into an authorised dealer to put your name down on the waiting list for a watch that is hard to get hold of, popular, and selling on the second hand market above the actual retail price.

If successful, you will get called up by the Authorised Dealer letting you know that your watch has come into stock. This allows you to confirm the current market prices for the watch, the demand, and your overall ability to sell this piece for a profit, before you even make a decision to buy it.

The benefit of this is that it cuts out risk and uncertainty from the flip significantly. The other benefit of this method is that there can be more significant price differentials between the retail price and the second hand market than there would be if you were buying and selling within the second hand market itself.

So if it’s so easy, why don’t more people do this? Well, the truth is, there’s a certain amount of groundwork you need to do in order to be offered the watch you want in the first place. There’s also only so many watches that become available, and only so many dealers to get them from … and if any of them get a whiff that you are planning to flip, you can end up blacklisted from buying from that particular dealer. This limits the frequency and repeatability of this way of flipping watches.

So what groundwork is actually needed? Well, first of all, you are going to need to build up a certain level of trust with your Authorised Dealer.

An Authorised Dealer (AD) is a retailer with delegated authority to sell brand new watches from particular luxury watch brands such as Rolex. For example, Watches Of Switzerland Group have retailers around the world that are official stockists of the top watch brands of the world. ADs are the only place you can buy brand new models from the top watch brands of the world, although some brands will also operate boutiques of their own.

A knowledge / interest in watches is key to building up a relationship. Speak to a salesperson at an authorised dealer, and nerd out with them on the different models you like and talk about your dream timepieces you would love to own. If you’re in the market for a watch for yourself you can even consider buying one from the dealer you plan to flip with, this definitely helps. Otherwise, take their card, and remember their name.

Once you have earned their trust, you can now make your play for the watch you really want. Call up and ask if you can speak to the salesperson from your last visit, and make an appointment. Go there in-person and strike up a friendly conversation with them, and tell them which watch you are dreaming about. Bonus points if you tell them that it’s for a special occasion. If it’s for a wedding, or a big milestone like an anniversary or 30th birthday, even better. This will only increase your chances.

If you do a good job on earning their trust and friendship, they will move heaven and earth for you to try and get hold of the watch that you want.

Now, which watch to actually choose? This is not an exact science.

Here you are trying to strike a balance between a watch with a high price differential between the retail and second hand prices, the length of the waiting list, and your likelihood of actually getting it.

Be realistic about it, there’s no way you are going to get offered the ultra hard to get hold of pieces during your first time, at the same time, you only get to do this once in a while, so it’s good to make it count. Most important of all, your story to the authorised dealer needs to be realistic. The watch needs to match the person, and the occasion/reason you want to buy it.

If you can find his/hers watches that both sell for above retail price, you can even put your name down for two at the same time. Authorised Dealers will love to source a pair of wedding watches for example.

When it comes to what price differential to aim for, I think it’s important to have some guidelines. Remember that this transaction will come with costs and risks, and so you need to make sure you adequately cover yourself for these, and have enough profit leftover to make the transaction worthwhile.

I believe the sweet-spot here is finding pieces that are around 30 to 50% more expensive on the second hand market than the retail. The problem with going higher is that the likelihood of getting the piece will go down dramatically, and the timeframe of the transaction will also be drawn out because of the length of the waitlist.

Much lower than 30%, and you are at the point where, after costs, you may not be making an attractive profit on the transaction (bearing in mind you will only get to do this a couple of times a year).

I have stuck to this range and have received two pieces in total, one after three months (30% differential), and the other after nine months (45% differential). I now have my name on the waiting list for another piece, this time a little more ambitious (60% differential), having now built up more trust, relationship, and track record with my authorised dealer. [Sorry if you are reading this … !]

Now let’s talk through how the transaction will actually be executed.

First of all, upon getting called up, it’s important to have a credit card with sufficient balance to pay for the transaction - you may also need to call your bank to inform them of the transaction so that payment goes through smoothly.

When the salesperson is preparing the watch, ask if they can leave the stickers on the watch for you to take them off later - this adds to the value and saleability of the watch when you resell it as ‘fully stickered’. Beware though, this can also be a tell-tale sign of a watch flipper, so only do it if you feel confident in your relationship with the salesperson.

It’s also important to think about safety - you should plan a safe route to and from the dealer. Take a cab home - it’s much safer, especially in central London. I also prefer to safely package the watch in its box within my own bag so that nothing is visible when leaving the dealer.

Now, you’re home, and probably full of adrenaline. It’s now time to carefully and stylishly photograph the watch. Ensure to show the completeness of the box and papers, and show the watch in crystal clear detail. Prepare the listing on Chrono24, and get ready to list it for sale. You will need your ID on hand to verify and confirm your account.

Choose a price that is at the lower end of the market for this particular model. Your price should be around the same price or slightly lower than the cheapest comparable listing on Chrono24 - this will generate interest and a quicker sale. Note that a private seller is not the same as a dealer. Even if it’s a few hundred pounds more, people will likely choose a dealer over a private seller, so be aware of this and position your listing accordingly.

Finally, people love to negotiate on Chrono24. That said, if your listing is the cheapest on the market, you can hold pretty firm most of the time, and still make the sale.

Once you have accepted a binding offer to sell the watch, the buyer will go on to deposit funds into an escrow account managed by Chrono24. At this point, you will carefully package the watch, and send the item to the buyer. You need to use a fully insured and reliable service like FedEx or UPS.

Once received, the buyer confirms the transaction, and funds are released to the seller (less fees). The escrow service that Chrono24 offers is important as it is how disputes are resolved - the money is not released or returned to the buyer unless everything has been kept ‘above board’ … protecting both buyer and seller.

Escrow is a legal concept describing a financial agreement whereby an asset or money is held by a third party on behalf of two other parties that are in the process of completing a transaction.

Escrow accounts are managed by the escrow agent. The agent releases the assets or funds only upon the fulfillment of predetermined contractual obligations (or upon receiving appropriate instructions). Money, securities, funds, and other assets can all be held in escrow.

Let’s now take a look at one of my own examples, and the numbers behind it.

In September 2021, I put my name down for a Rolex Skydweller 326933 - a two-tone stainless steel and yellow gold watch with an annual calendar complication and a black face. This is a sought after model, but not as sought after as the pure stainless steel versions.

The retail price for this piece was £14.8k (now £16.8k), and at the time I put my name down for this watch, the cheapest sale price on Chrono24 was around £21.5k. After about 9 months, I received my call from the AD, checked the prices were still well above the retail price, and headed into the dealer to purchase the watch.

I couldn’t resist trying it on …

Now let’s get into the numbers, and the cold hard cash.

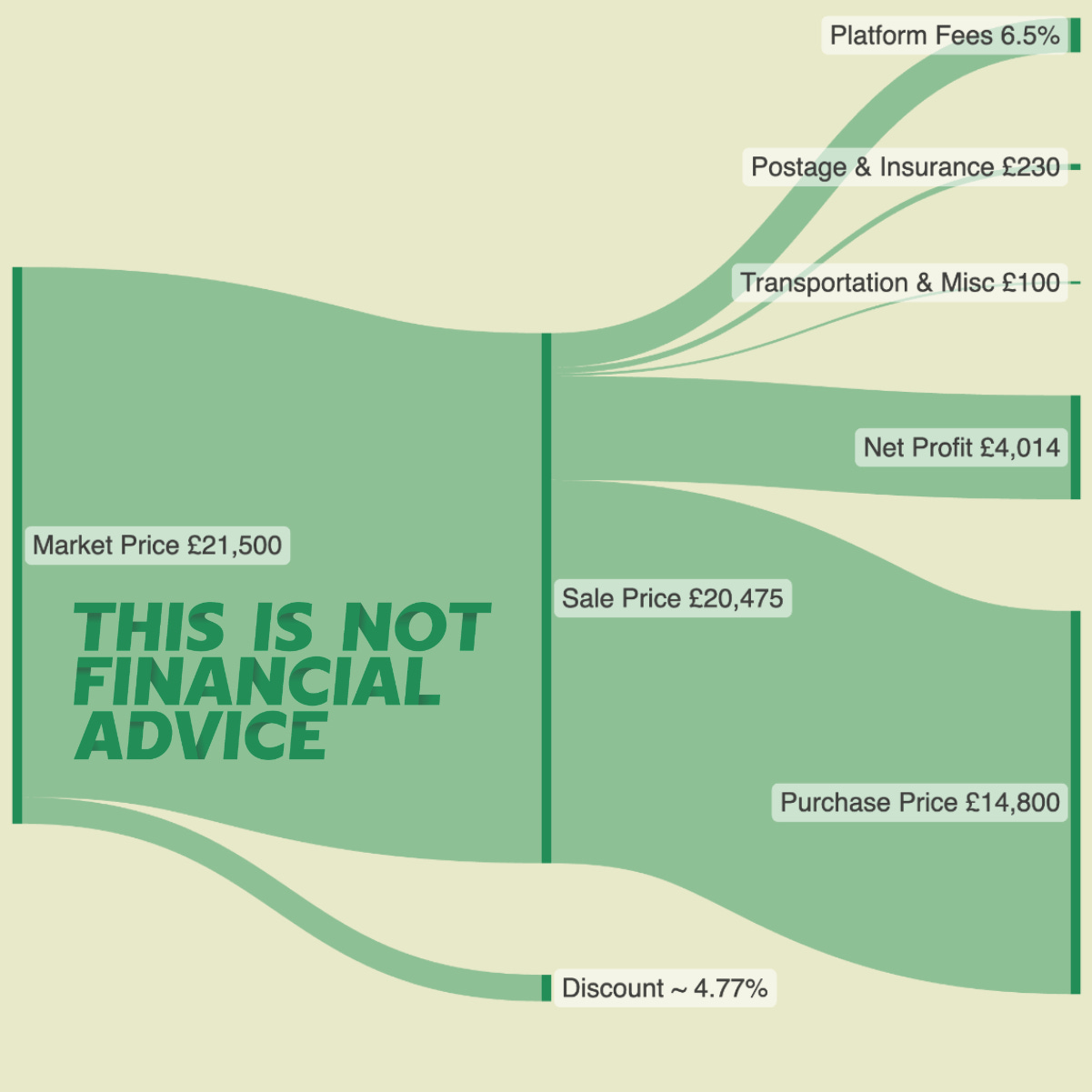

The cheapest comparable (brand new, unworn) on Chrono24 was £21.5k from a known dealer. I undercut this by listing for £20,975, and within two weeks (and a few cheeky offers from watch traders) sold the watch for £20,475.

After Chrono24 deducted their 6.5% fee, this gave proceeds from sale of ~£19,144. This is what you actually receive into your bank account as a payout.

As this is a very expensive item, I spent around £230 on postage via UPS. This was to make sure the item reached the buyer ASAP, without issues, and fully insured along the way. I also incurred some other costs like packaging, my taxi to and from central London, and so on. Call it £100.

The final and biggest cost is of course the cost of the watch itself. This was £14,800.

All in all, the transaction netted me a total profit of over £4,014, in just 3 weeks from start to finish. In fact, I hadn’t even yet made my credit card payment by the time the funds hit my current account. In terms of hours, there was probably around 3-4 hours work involved, mainly going into the AD to collect and pay for the watch.

To recap, here is a diagram of the P & L of this transaction:

To summarise then:

Find the right watch, and form a relationship with an AD

Put your name down for something realistic but profitable

When you get the call, confirm the demand and up-to-date market price

Prioritise safety when going to pick up the watch

List it with attractive photos and pricing, negotiate a good sale price

Use the Chrono24’s escrow service

Post using a premium, fully insured, service

Collect your profits!

Bonus tip: don’t reveal your sources or serial numbers online, as you may be barred from buying from your AD in the future if they come across your watch online.

There are a lot of pros to this occasional side hustle:

Minimal effort - it only takes a few hours every once in a while

Minimal risk on price (as you can check market prices before you commit)

Bigger price differentials versus second hand flipping

Quick turnaround - the transaction should take < 4 weeks

There are also some clear cons:

If the sale takes a while, you could face cash flow challenges

Limited repeatability - this is not a full side hustle

Unpredictability of timing - you never know when/if you will get called up

You need to think carefully about safety/security

You may need to bend the truth with your authorised dealer to avoid being blacklisted by them

If you are very knowledgeable and interested in watches, and have more time to devote, you can also consider flipping second hand watches. This is more difficult, as price differentials are much smaller and so it’s harder to make good margins on a flip. You are also far more open to fraud depending on how you source your stock.

Pros:

Knowledge is readily rewarded - if you know your stuff you will do well

There are a whole galaxy of flipping opportunities, allowing you to flip more frequently and generate a genuine second income from flipping watches

Cons:

Price Risks - price movements can affect profitability, and when margins are smaller this risk becomes more significant

Fraud Risks - you can also be at more risk of receiving counterfeit watches, than when buying from an authorised dealer

Smaller Margins - the rewards per transaction/risk are generally much smaller, meaning that this is a volume game

Safety, Storage & Security - if you become known as a watch trader, it is possible you could be targeted by thieves, a big risk if you have a stock of luxury watches

Time invested - because of the volume nature of this game, it is time consuming to generate sufficient earnings

My take is that it is much easier and more pleasant to make an occasional quick buck, and be happy, rather than trying to make an actual living with this. I would also remind you to think about your own personal circumstances before trying to execute any of the strategies described here. They will not suit everyone, and this article is not intended to be financial advice!

Thanks a lot for subscribing and reading today, and I would love to answer any questions that you have in the chat. Which watch are you buying or flipping?