Why I'm sticking with one of my favourite investments: Plus500

My returns, conviction, and why I am staying invested

Some investments I make in public companies are based on a conviction that the share price or public perception of a company is wildly out of sync with reality — with an expectation that within a relatively short period (say 6 to 12 months), either the company or markets will reevaluate and correct the misunderstanding.

An example of this was picking up META at around $95 per share back in November 2022. Public markets had become exasperated by Mark Zuckerberg’s obsession with the metaverse. The company had just posted brutal earnings and announced tens of billions in metaverse spending. That year, the share price had plummeted from around $350 to lows of $130, and following earnings fell further to around $92. My strong conviction at the time was that, after being decimated by the markets so badly once again, META would have no choice but to “find god”. In this case, my conviction was right, and in 2023 META announced the “year of efficiency” pivot, which led to massive cost cuts & layoffs, surging free cash flow, and a sharp re-rating of the stock.

Likewise, I bought Netflix in mid-2022 for around $187 per share, when shares had collapsed following their first-ever subscriber loss and widespread talk of “streaming fatigue.” The narrative was that Netflix’s growth story was over, and that competition from Disney+, HBO Max, and others would eat into margins. But from my perspective, the fundamentals told a different story: Netflix still had the strongest global position, industry-leading profitability, and a near-monopoly on the cultural zeitgeist with its content. That conviction also proved right. Within a year, Netflix reinvented its growth through its password-sharing crackdown, price increases (enabled by its dominant grip on popular culture), and the launch of its ad-supported tier, reigniting subscriber growth and expanding margins. The market quickly caught up to the reality I’d seen earlier — and the shares more than tripled within a 2 year period.

These kinds of opportunities are hard to come by — they depend on moments of deep market misunderstanding, which tend to arise only during turbulent times. When they do come around, you need to spot them, be correct in your conviction—which is not always the case(!!), and act quickly & decisively to take advantage.

Luckily though, a second more long term type of investment is possible, one based on owning compounding machines — businesses with durable economics, strategic clarity, and a long term path of outsized cash generation. As Benjamin Graham famously put it, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine”. If you pick the right compounding machine, regardless of market sentiment and fluctuations, the underlying economics will eventually force the market to take notice.

Today I am going to share one such company I have been invested in for several years — Plus500, a publicly listed fintech trading platform.

I first invested in 2020, after screening a bunch of companies based on their Free Cash Flow to Enterprise Value ratio, and going through my lists to find companies in the kind of sectors I was excited about. At the time, retail investing was experiencing a major resurgence during COVID, with a new wave of retail traders entering the markets.

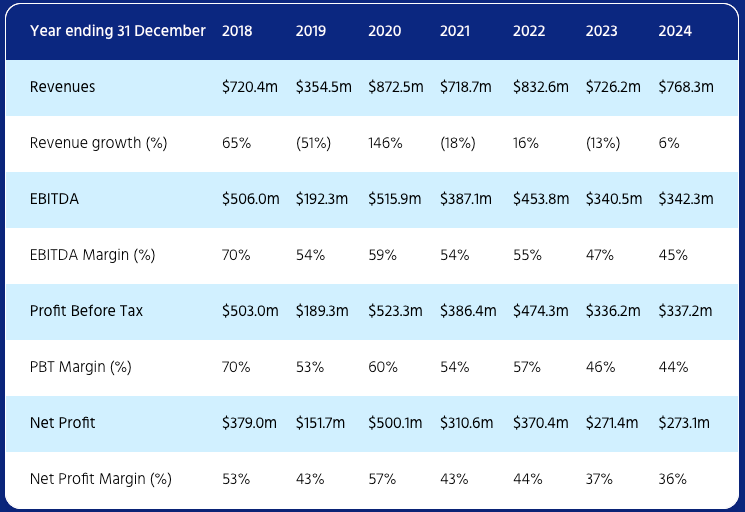

From a fundamentals standpoint, Plus500 immediately stood out. It was (and still is) exceptionally profitable, with strong free cash flow generation, a rock-solid balance sheet, and significant cash returns to shareholders through dividends and buybacks.

(Source: Plus500 Investor Relations)

On most traditional metrics — EV-to-earnings, price-to-cash-flow, and other valuation multiples — with a market cap of only around £1.5b in May 2020, it traded at a steep discount to peers like CMC Markets & IG Group, despite superior margins and returns on capital.

One reason for this is that Plus500 operates a B-book model, meaning that it takes the other side of customer trades, rather than hedging with a liquidity provider.

This approach, often misunderstood by investors, gives Plus500 higher margins, but also exposes the P&L to fluctuations in trading performance. This perhaps also explains the lower valuation multiples achieved by Plus500, with markets pricing in that extra perceived risk. Plus500 however has excellent technology and has consistently proven its operational and risk management capabilities in volatile markets over the past several years.

Volatility in general is actually excellent for trading platforms like Plus500, who make money from spreads and big swings in volatile market conditions. With the current macro and geo-political climate the way it is, and financial markets at fever-pitch with AI-driven hype, I believe that a continuing and prolonged period of volatility is likely in the coming years, benefitting Plus500. Given that retail trading positions tend to be net-long, this makes Plus500 a natural hedge against falling markets (when markets become volatile and fall dramatically — Plus500 tends to win big, producing bumper profits).

From a growth economics perspective, Plus500 has already acquired a massive and sticky user base — a long-term asset that has largely been expensed in prior years. In other words, much of the customer acquisition cost is already behind the company, yet the lifetime value of those users continues to compound. Every new cohort of traders adds incremental revenue on top of a highly cash-generative base, creating strong operational leverage without the need for heavy reinvestment — Plus500 though does opt to invest significantly in continuing to acquire new, and especially high value, users.

Another attractive quality of Plus500 is its rock solid balance sheet, with over $800m in cash and no debt. It operates an aggressive shareholder returns policy with its free cash flow — returning 50% or more to shareholders via dividends and buybacks (during my ownership, shares outstanding have dropped from over 100m in 2020 to around 70m today).

Outside of shareholder returns, Plus500 is engaged in geographical and product/market expansion via organic and inorganic means — gaining licenses in new territories as well as engaging in several M&A deals in the last 5 years, including:

Cunningham Commodities & Trading Systems LLC (USA) in 2021

EZ Invest Securities (Japan) in 2022

Mehta Equities Limited (India) in 2025

Historically, CFDs (the main product which Plus500 trades) have been somewhat stigmatised by the financial markets. They are viewed as speculative and retail driven instruments that are sensitive to regulation — with this skepticism long-weighing on Plus500’s valuation multiples, and investors assigning a lower quality of earning rating to earnings derived from CFD trading.

These diversification efforts are part of a clear strategy to position Plus500 as a diversified fintech platform, rather than a simple CFD trading house. If successful, these efforts will not only grow revenues and earnings, but also quality of earnings, leading to a re-rating over time of Plus500’s risk profile and valuation multiples.

Longer-term, once Plus500’s presence in the US is more well established, a dual listing on the NASDAQ could unlock a further uplift in valuation multiples.

To sum up, as an investor, I like the following:

Strong technology, market positioning, growth and operating engine

Consistently high trading volumes, driven by continuing macro turbulence (something which, in the current era, I can’t see changing)

Rock-solid balance sheet with over $800m in cash and no debt

Continued, significant, and consistent cash flows from operations

Significant shareholder returns via dividends & substantial buybacks

Acts as a natural hedge to volatility and market downturns

Significant geographic expansion and diversification via small-scale M&A

Growing US presence and clear strategy of diversification away from CFDs should increase quality of earnings, risk perception, and valuation multiples

The potential to dual-list on the NASDAQ presents a huge re-rate opportunity

What’s not to like?

Well, as I mentioned, key risks remain regulatory — particularly leverage caps or retail access changes in the EU. Plus500’s diversification helps, but these aren’t negligible. Institutional investors are wary of this, and have this firmly factored in.

However, with every year that goes by, Plus500 makes more profits, accumulates more cash, pays more dividends, and buys back more shares (concentrating ownership for the remaining shareholders)… and if, like me, you have conviction that the company will continue to do that for many years to come, then you don’t need the market to recognise the value straight away — eventually, the combination of a shrinking share count and a growing cash pile becomes impossible to ignore. Again, in the long-run, the stock market is a weighing machine.

In the meantime, if the company manages to reshape its market perception (and it has made significant progress here too), a re-rate could be in order too.

As of Q3 2025, Plus500 generated $598m in revenue and $268m in EBITDA in the first 9 months of 2025, representing an EBITDA margin of 44.8%. The company re-iterated full year guidance of $750m in revenue and $343m in EBITDA (Bloomberg consensus). The company remains debt-free with over $815m in cash, giving it a net cash position equivalent to roughly one-quarter of its market cap. At the current share price (~£32.76), Plus500 trades at roughly 10 to 11 × forward earnings, 6.5 × EV/EBIT, with a free-cash-flow yield just under 10%. While these multiples were even more attractive at my original entry point, they remain highly competitive relative to peers.

From my perspective, Plus500 continues to represent the kind of business I like to own: profitable, well-capitalised, shareholder-friendly, and positioned to benefit from ongoing volatility in global markets. So I’m happy to continue holding — and if the company continues to compound cash, reduce its share count, and gradually reshape market perception, I believe patience will continue to be rewarded.

Returns:

Entry price: £12.80 per share

Current price: £32.76 per share (+155.9%)

Dividends to date: £6.84 (+53.4%)

Total return: £26.80 per share (209.4%)

IRR: 27.5% (based on dividend payment timing, entry, and exit dates)